- Q3 2021 Revenue of $33.0 million, up 45% compared to Q3, 2020

- Q3 2021 Adjusted EBITDA[1] of $3.5 million

All figures are reported in United States dollars ($) unless otherwise indicated

LAS VEGAS, NV / ACCESSWIRE / November 23, 2021 / Planet 13 Holdings Inc. (CSE:PLTH) (OTCQB:PLNHF) ("Planet 13" or the "Company"), a leading vertically-integrated cannabis company, today announced its financial results for the three-month and nine-month period ended September 30, 2021. Planet 13's financial statements are prepared in accordance with International Financial Reporting Standards ("IFRS").

"We continued to drive strong performance during the quarter from our core Las Vegas operations," said Larry Scheffler, Co-CEO of Planet 13. "Along with our dispensary operations, our product brands are performing well with Trendi vapes seeing 110% dollar sales growth year over year according to Headset. It now makes up about ~5% of Vape sales and 7% of Concentrate sales and HaHa edibles was ~14% of edibles sales in the State."

"Along with stellar performance from our Nevada operations, this was a massive quarter towards securing the future growth of Planet 13. We opened our California store, and while initial sales growth has been slower due to headwinds from COVID and untimely road construction around the SuperStore, customer reviews have been outstanding. We expect growth as those headwinds abate," commented Bob Groesbeck, Co-CEO of Planet 13. "We also won a dispensary license for the Chicago area giving us a clear path for our next SuperStore, and acquired a Florida license that will allow us to vertically integrate and open multiple neighborhood and SuperStores in the state."

Financial Highlights - Q3 - 2021

Operating Results

All comparisons below are to the quarter ended September 30, 2020, unless otherwise noted

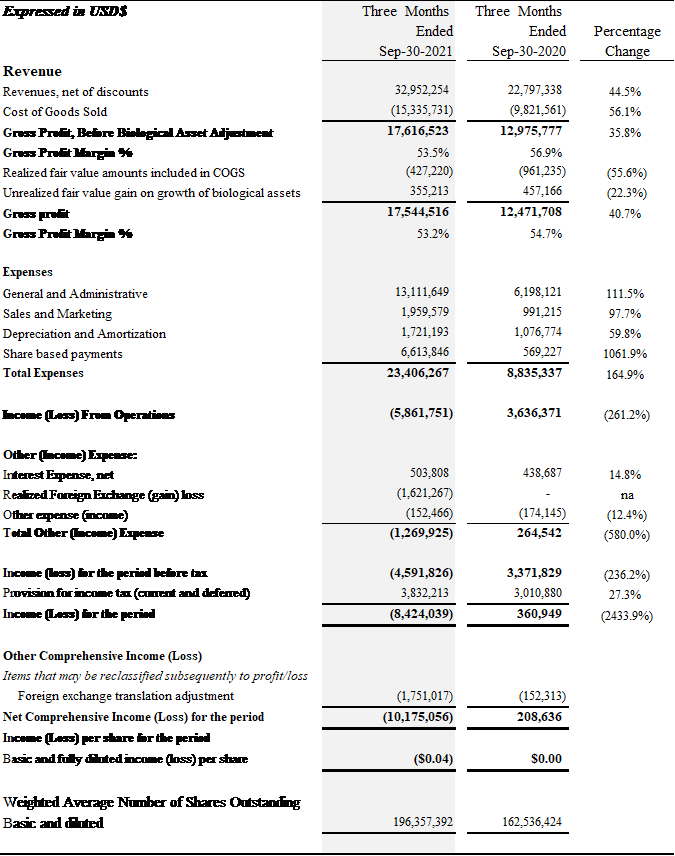

- Revenues were $33.0 million as compared to $22.8 million, an increase of 45%

- Gross profit before biological adjustments was $17.6 million or 53.5% as compared to $13.0 million or 56.9%

- Operating expenses, excluding non-cash compensation expense and depreciation and amortization, was $15.1 million as compared to $7.2 million, an increase of 110%

- Net loss before taxes of $4.6 million as compared to a net profit of $3.4 million

- Net loss of $10.2 million as compared to a net profit of $0.2 million

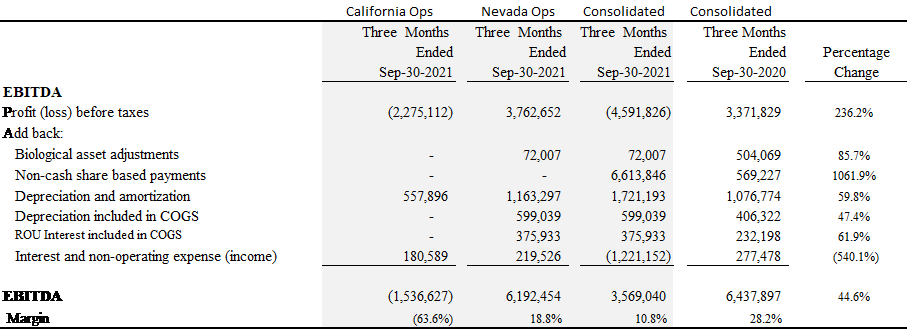

- Adjusted EBITDA of $3.6 million as compared to Adjusted EBITDA of $6.4 million

[1] Adjusted EBITDA is a non-GAAP financial measure

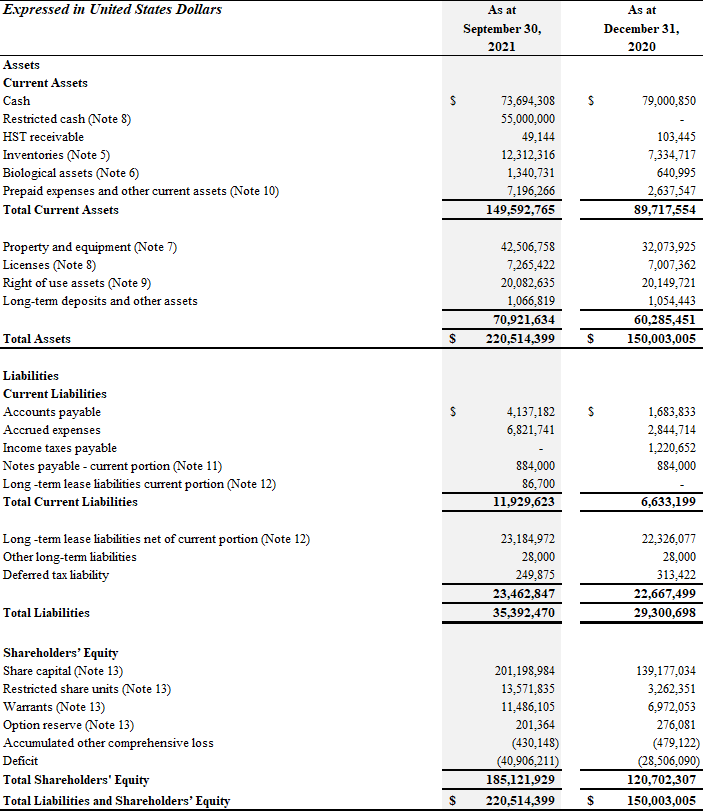

Balance Sheet

All comparisons below are to December 31, 2020, unless otherwise noted

- Cash of $73.7 million as compared to $79.0 million

- Total assets of $220.5 million as compared to $150.0 million

- Total liabilities of $35.4 million as compared to $29.3 million

Q3 Highlights and Recent Developments

For a more comprehensive overview of these highlights and recent developments, please refer to Planet 13's Management's Discussion and Analysis of the Financial Condition and Results of Operations for the Three and Nine Months Ended September 30, 2021 (the "MD&A").

- On July 1, 2021, Planet 13 opened the Orange County SuperStore.

- On July 7, 2021, Planet 13 announced Moxie as the third store-in-store in Orange County SuperStore.

- On July 14, 2021, Planet 13 announced the results of its AGM.

- On August 5, 2021, Planet 13 announced that its 49% owned subsidiary Planet 13 Illinois won a Chicago dispensary license.

- On September 1, 2021, Planet 13 announced a definitive agreement to acquire a Florida cannabis license.

- On September 21, 2021, Planet 13 announced the doubling of the dispensary floor space at the Las Vegas SuperStore.

- On October 1, 2021, Planet 13 announced the close of its acquisition of Florida cannabis license.

Results of Operations (Summary)

The following tables set forth consolidated statements of financial information for the three-and nine-month periods ending September 30, 2021, and September 30, 2020. For further information regarding the Company's financial results for these periods, please refer to the Company's financial statements for the period ended September 30, 2021, together with the MD&A, available on Planet 13's issuer profile on SEDAR at www.sedar.com and the Company's website https://www.planet13holdings.com.

Adjusted EBITDA[2]

[2] Adjusted EBITDA is a non-GAAP financial measure

Outstanding Shares

As of November 23, 2021, the Company had 196,463,520 common shares outstanding. There were 169,168 options issued and outstanding of which 169,168 have fully vested. There were 8,875,651 warrants outstanding and 4,927,869 RSU's outstanding of which nil 104,440 had fully vested as at the date of this MD&A.

Conference Call

Planet 13 will host a conference call on Tuesday, November 23, 2021 at 5:00 p.m. ET to discuss its third quarter financial results and provide investors with key business highlights. The call will be chaired by Bob Groesbeck, Co-CEO, Larry Scheffler, Co-CEO, and Dennis Logan, CFO.

CONFERENCE CALL DETAILS

Date: November 23, 2021 | Time: 5:00 p.m. EST

Participant Dial-in: Toll Free 888-506-0062 or International 973-528-0011

Replay Dial-in: Toll Free 877-481-4010 or International 919-882-2331

(Available for 2 weeks)

Reference Number: 571591

Listen to webcast: https://bit.ly/3ccZOce

Financial Measures

There are measures included in this news release that do not have a standardized meaning under generally accepted accounting principles (GAAP) and therefore may not be comparable to similarly titled measures and metrics presented by other publicly traded companies. The Company includes these measures because it believes certain investors use these measures and metrics as a means of assessing financial performance. Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) is calculated as net earnings before finance costs (net of finance income), income tax expense, share-based compensation, one-time costs and depreciation and amortization of intangibles and is a non-GAAP financial measure that does not have any standardized meaning prescribed by IFRS and may not be comparable to similar measures presented by other companies.

For further inquiries, please contact:

LodeRock Advisors Inc., Planet 13 Investor Relations

[email protected]

Bob Groesbeck and Larry Scheffler

Co-Chief Executive Officers

[email protected]

About Planet 13

Planet 13 (www.planet13holdings.com) is a vertically integrated cannabis company, with award-winning cultivation, production and dispensary operations in Las Vegas and dispensary operations in Orange County, California. Planet 13 also holds a medical marijuana treatment center license in Florida and a 49% interest in Planet 13 Illinois which won a lottery for a Social-Equity Justice Involved dispensing license in the Chicago-region of Illinois. Planet 13's mission is to build a recognizable global brand known for world-class dispensary operations and a creator of innovative cannabis products. Planet 13's shares trade on the Canadian Stock Exchange (CSE) under the symbol PLTH and OTCQX under the symbol PLNHF.

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward looking-statements relate to, among other things, securing our next growth opportunities, growing consumer awareness of our Orange County location, ultimately driving the sales we know are possible from that location, the dispensary license for the Chicago area giving us a clear path for our next SuperStore, a robust M&A pipeline and Planet 13's future being bright.

These forward-looking statements are based on reasonable assumptions and estimates of management of the Company at the time such statements were made. Actual future results may differ materially as forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to materially differ from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors, among other things, include: final regulatory and other approvals or consents; risks associated with COVID-19 and other infectious diseases presenting as major health issues; fluctuations in general macroeconomic conditions; fluctuations in securities markets; expectations regarding the size of the Nevada and California cannabis market and changing consumer habits; the ability of the Company to successfully achieve its business objectives; plans for expansion; political and social uncertainties; inability to obtain adequate insurance to cover risks and hazards; and the presence of laws and regulations that may impose restrictions on cultivation, production, distribution and sale of cannabis and cannabis related products in the State of Nevada and California; and employee relations. Although the forward-looking statements contained in this news release are based upon what management of the Company believes, or believed at the time, to be reasonable assumptions, the Company cannot assure shareholders that actual results will be consistent with such forward-looking statements, as there may be other factors that cause results not to be as anticipated, estimated or intended. Readers should not place undue reliance on the forward-looking statements and information contained in this news release. The Company assumes no obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by law.

The Company is indirectly involved in the manufacture, possession, use, sale and distribution of cannabis in the recreational and medicinal cannabis marketplace in the United States through licensed subsidiary entities in states that have legalized marijuana operations, however, these activities are currently illegal under United States federal law. Additional information regarding this and other risks and uncertainties relating to the Company's business, including COVID-19, are contained under the heading "Risk Factors" and elsewhere in the Company's annual information form dated April 5, 2021 filed on its issuer profile on SEDAR at www.sedar.com.

No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (LOSS) AND

COMPREHENSIVE INCOME (LOSS)

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

SOURCE: Planet 13 Holdings