TORONTO, ON / ACCESSWIRE / January 17, 2024 / Star Royalties Ltd. ("Star Royalties", or the "Company") (TSXV:STRR)(OTCQX:STRFF) is pleased to announce that its joint venture, Green Star Royalties Ltd. ("Green Star"), has entered into an agreement with Locus Agricultural Solutions LLC ("Locus AG") to improve the operating structure of and its royalty investment into Locus AG's regenerative agriculture carbon farming program, CarbonNOW®. In addition, the program continues to progress through the registration process and is now listed under the validation category on the Verra Registry ("Verra").

Key Highlights

- Improved CarbonNOW operating structure: Green Star, Locus AG and Anew Carbon Farming, LLC ("Anew") and certain of their affiliates have agreed to make Locus AG the project operator and formal manager of CarbonNOW. Anew will continue to provide project development and technical services on a fee-for-service basis and will lead the project's validation and verification efforts, as well as conduct carbon credit marketing and sales. The revised operating structure creates stronger alignment between all parties, enables all parties to focus on their core strengths, de-risks program execution, and is expected to result in improved operational efficiencies with respect to future farmer enrollment and data collection and analysis.

- Enhanced program economics and extended royalty term: As part of optimizing the program, Green Star has agreed to revise its proceeds sharing agreement that is currently with an affiliate of Anew and will partner directly with Locus AG for a 30% gross revenue royalty on CarbonNOW. Green Star's initial US$20.6 million funding commitment remains unchanged, although the revised royalty term has been extended from 10 years to 20 years, resulting in meaningfully greater exposure to longer-term carbon pricing and sequestration performance.

- CarbonNOW program enters third-party validation process: The CarbonNOW program, as part of project ID 4236, was officially listed under Verra's Methodology for Improved Agricultural Land Management, v2.0 ("VM0042") in September and is currently proceeding towards third-party validation. The listing and the upcoming validation are important milestones in advancing and de-risking the 1.32-million-acre program towards carbon credit issuance.

- CarbonNOW farmer payments in 2023 exceeded US$2.8 million: U.S. farmers who have implemented regenerative agriculture practices and enrolled into the CarbonNOW program prior to the 2023 growing season have received over US$2.8 million in 2023 to date, highlighting the program's rapid year-over-year growth and farmer benefits. In total, Green Star has invested over US$5.5 million in the CarbonNOW program.

Alex Pernin, Chief Executive Officer of Star Royalties, commented: "We are excited to announce these multiple positive developments with the CarbonNOW program. The revised CarbonNOW structure creates an improved and strategic alignment with Locus AG and will drive superior workflow to maximize farmer enrollment and soil carbon sequestration, while Anew continues to provide key support services. The revised gross revenue royalty structure will also improve transparency and reduce risk, while the term extension from 10 to 20 years provides significantly greater exposure to longer-term carbon pricing and sequestration performance for the same royalty investment amount."

"The program's listing with Verra marks an important milestone towards generating and issuing premium North American carbon credits from regenerative agricultural practices. We are seeing robust demand for nature-based solutions and anticipate these types of offsets to transact around US$20/tCO2e. Furthermore, our program has paid out approximately US$4.5 million to U.S. farmers and we look forward to continued farmer enrollment into the program."

Vic Peroni, Chief Commercial Officer at Locus AG, commented: "We believe this strategic realignment with Green Star and Anew will provide significant operational and economic efficiencies for the CarbonNOW program and allow for Locus AG to improve the overall management and execution of the program with farmers. Green Star's commitment to the CarbonNOW program, the farmers and to Locus AG has always been apparent, and having a direct relationship with Green Star is crucial for the success of the overall program."

Angela Schwarz, Chief Executive Officer of Anew Climate, LLC, reiterated the importance of the strategic realignment in ensuring the long-term success of the CarbonNOW program and further commented: "CarbonNOW incentivizes adoption of an innovative and additional solution to achieve land-based carbon removals. Anew has firm demand at significant volume for the CarbonNOW credits at substantially higher pricing than industry reports for nature-based credits. We are pleased to provide project development and marketing services in support of the CarbonNOW program and are confident that the voluntary carbon market will continue to demand and pay a premium for such projects due to their enormous contribution to climate action, biodiversity and natural capital."

Improved CarbonNOW Structure, Economics and Royalty Term Extension

CarbonNOW has been optimized to ensure maximum carbon removals and avoidance, as well as alignment between all involved parties. Green Star, Locus AG, Anew and certain of their affiliates have agreed to make Locus AG the project operator and formal manager of CarbonNOW. Locus AG will oversee all data management and continue to actively recruit farmers under this program until a total of 1.32 million acres of farmland across the United Sates have been enrolled. Anew will remain the program's carbon developer, leading registration and issuance efforts with Verra, as well as executing all carbon credit marketing and sales. Green Star will continue to finance CarbonNOW's initial eligible expenses, farmer payments and registration fees, through quarterly drawdowns by Locus AG, as required, until the previously committed capital contribution of up to US$20.6 million is fully invested. Green Star currently expects to provide the remaining US$15.1 million of capital contributions by 2026.

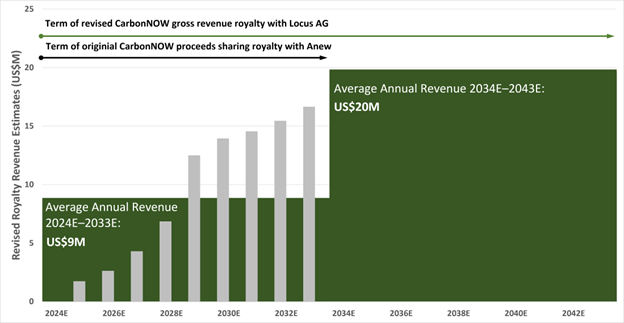

As part of optimizing the program, Green Star will revise its proceeds sharing agreement that is currently with an affiliate of Anew. Green Star will partner directly with Locus AG and will receive a 30% gross revenue royalty, payable from CarbonNOW's gross carbon revenues. The royalty will be payable in cash from the sale of carbon credits or directly in carbon credits, at Green Star's election. The term of the royalty will also be increased from 10 years to 20 years of carbon credit issuance to better capture the longevity and durability of the CarbonNOW program. It should contribute significant incremental cash flow generation to Green Star through the early 2040's (see Figure 1).

The revised royalty agreement will also account for and incorporate the impact of recent revisions in VM0042 (as described below), ensuring the competitiveness and robustness of the CarbonNOW program across the extended royalty term. Approximately 310,000 acres of U.S. farmland are currently enrolled in the program, representing the full scope of the original pilot program. As part of this triparty optimization effort, significant focus has been placed on increasing the selectivity of eligible growers to prioritize the highest quality acres and to maximize the carbon sequestration potential of these acres. This approach will ensure a consistently measured and effective ramp-up pace towards the 1.32 million acres. Green Star's attributable cash flow from the CarbonNOW program is estimated to represent approximately 75,000 carbon credits in 2025, increasing towards 400,000 carbon credits per year over the following 20 years.

Figure 1: Green Star's Revised Estimated Royalty Revenues from CarbonNOW

Verra Registration Progress

The CarbonNOW program was officially listed under VM0042 on September 19, 2023, under the "Anew Agri-carbon Aggregation 1" project (ID 4236). The project's 30-day public consultation period was completed in October. CarbonNOW is now transitioning to its validation phase with the engagement of a third-party validation and verification body. Anew expects the validation process to commence by Spring 2024 and be completed by Fall 2024. Given that VM0042 was only publicly released in late May 2023 and given its additional conservatism as well as other Verra VCS Standard revisions, CarbonNOW will look to combine the 2022 and 2023 growing seasons to more effectively and efficiently quantify the cumulative carbon sequestration potential under one verification process. The verification phase is expected to commence following validation in Fall 2024 and would result in CarbonNOW's first offset issuance, as well as first royalty revenues to Green Star, in 2025.

Farmer Payments

The approximately US$4.5 million paid to U.S. farmers to-date has funded ongoing enrollments in the CarbonNOW program and signifies its rapid year-over-year growth. By financially incentivizing practice changes, Green Star and Locus AG, with support from Anew, are assisting farmers in fulfilling their crucial role in decarbonizing the food system. The CarbonNOW program involves the application of probiotic-based soil additives, known as biologicals, that increase soil fertility and plant productivity, and in turn, soil carbon sequestration. As part of the program, farmers will receive incentive payments for the soil additives and per-acre payments upfront to overcome financial barriers to implementation. Additional carbon-linked payments will be paid to farmers based on the net carbon sequestration performance of their acreage, following data collection and verification of soil samples that result in per-acre carbon crediting. In 2023 alone, over 22,000 soil carbon samples were taken across CarbonNOW's enrolled acres. The rigorous verification process is intended to provide transparency and assurance for quality-conscious buyers, who are drawn to regenerative agriculture for its climate mitigation impacts, as well as its benefits to U.S. farming communities.

Engagement of Market Maker

Star Royalties has retained Integral Wealth Securities Ltd. ("Integral") to provide market-making services in accordance with TSX Venture Exchange policies. Integral will trade shares of the Company on the TSX Venture Exchange to maintain an orderly market and improve the liquidity of Star Royalties' shares. Under the agreement between the Company and Integral ("Agreement"), Star Royalties has agreed to pay Integral a monthly fee of C$6,000 plus applicable taxes. The initial term of the Agreement is three months, and such term will be automatically renewed month-to-month, unless terminated by the Company on 30 days' prior written notice. Integral will not receive any shares or options as compensation.

Star Royalties and Integral are unrelated and unaffiliated entities. Integral has informed the Company that it has no present, direct or indirect, interest in Star Royalties or any securities of Star Royalties. Integral is an independently owned investment dealer with head offices in Toronto, Ontario and is a member of Canadian Investment Regulatory Organization and a member firm of the TSX Venture Exchange.

CONTACT INFORMATION

For more information, please visit our website at starroyalties.com or contact:

| Alex Pernin, P.Geo. Chief Executive Officer and Director [email protected] +1 647 494 5001 | Dmitry Kushnir, CFA Vice President, Investor Relations [email protected] +1 647 494 5088 |

About Locus Agriculture

Locus Agriculture (Locus AG) is an agriculture biological company that consistently pairs the most vital inputs with data-driven guidance to help growers achieve more productive, sustainable crops. Its globally recognized CarbonNOW® carbon farming program gives farmers a new way to boost yields, profit and accelerate carbon sequestration while reducing operating costs and environmental impact. Locus AG gets its core scientific capabilities from its parent company, Locus Fermentation Solutions (Locus FS), an Ohio-based green technology powerhouse. For more information, visit LocusAG.com.

About Anew Carbon Farming, LLC and Anew Climate, LLC

Anew Carbon Farming, LLC ("ACF"), a wholly owned subsidiary of Anew Climate, LLC ("Anew"), facilitates Anew's engagement in regenerative agriculture projects. Anew is accelerating the fight against climate change by enabling companies and organizations to align their goals for conservation and impact with actionable next steps. With a comprehensive solutions portfolio that includes advisory services, carbon credits, renewable natural gas, renewable energy certificates, EV credits, and emission credits, Anew lowers barriers to participation in environmental markets for clients across the private and public sectors. As a leading marketer and originator of environmental products, the company brings together strategic finance, regulatory expertise, scientific knowledge, and impact focus to make it possible for businesses to thrive while building a sustainable future. Anew is majority owned by TPG Rise, TPG's global impact investing platform, and emerged from the February 2022 combination of durational industry leaders Element Markets, LLC and Blue Source, LLC. The company has offices in the U.S., Canada, and Europe, and an environmental commodities portfolio that extends across five continents.

About Star Royalties Ltd.

Star Royalties Ltd. is a precious metals and carbon credit royalty and streaming company. The Company innovated the world's first carbon credit royalties in forestry and regenerative agriculture through its pure-green joint venture, Green Star Royalties Ltd., and offers investors exposure to precious metals and carbon credit prices with an increasingly negative carbon footprint. The Company's objective is to provide wealth creation by originating accretive transactions with superior alignment to both counterparties and shareholders.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

Certain statements in this news release may constitute "forward-looking statements", including those regarding future market conditions for metals, minerals and carbon offset credits, future capital raising opportunities, future funding under the proceeds sharing agreement and the future business growth of Green Star. Forward-looking statements are statements that address or discuss activities, events or developments that the Company or Green Star expects or anticipates may occur in the future. When used in this news release, words such as "estimates", "expects", "plans", "anticipates", "will", "believes", "intends" "should", "could", "may" and other similar terminology are intended to identify such forward-looking statements. Forward-looking statements are made based upon certain assumptions and other important factors that, if untrue, could cause the actual results, performances or achievements of Star Royalties and Green Star to be materially different from future results, performances or achievements expressed or implied by such statements. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be an accurate indication of whether or not such results will be achieved.

A number of factors could cause actual results, performances or achievements to differ materially from such forward-looking statements, including, without limitation, changes in business plans and strategies, market and capital finance conditions, ongoing market disruptions caused by the Ukraine and Russian conflict, metal and mineral commodity price volatility, discrepancies between actual and estimated production and test results, mineral reserves and resources and metallurgical recoveries, mining operation and development risks relating to the parties which produce the metals and minerals Star Royalties will purchase or from which it will receive royalty payments, carbon pricing and carbon tax legislation and regulations, risks inherent to the development of the ESG-related investments and the creation, marketability and sale of carbon offset credits by the parties, the potential value of mandatory and voluntary carbon markets and carbon offset credits, including carbon offsets, risks inherent to royalty companies, execution of the proceeds sharing agreement on the terms contemplated herein, title and permitting matters, operation and development risks relating to the parties which develop, market and sell the carbon offset credits from which Green Star will receive royalty payments, changes in crop yields and resulting financial margins regulatory restrictions, activities by governmental authorities (including changes in taxation), currency fluctuations, the global, federal and provincial social and economic climate in particular with respect to addressing and reducing global warming, natural disasters and global pandemics, dilution, risk inherent to any capital financing transactions, risks inherent to a possible Green Star go-public transaction, the nature of the governance rights between Star Royalties, Cenovus Environmental Opportunities Fund Ltd. and Agnico Eagle in the operation and management of Green Star and competition. These risks, as well as others, could cause actual results and events to vary significantly. Accordingly, readers should exercise caution in relying upon forward-looking statements and the Company undertakes no obligation to publicly revise them to reflect subsequent events or circumstances, except as required by law.

SOURCE: Star Royalties Ltd.